Equity management

Equity management priorities

Each year, the CHS Board of Directors makes decisions on the amount of cash patronage and equity redeemed and distributed to owners. 这些决定基于三个关键标准:

CHS has returned $3.2 billion to owners over the past 10 years

Challenges

Through consultation with tax, legal and capital structure experts, CHS董事会确定了CHS股权澳门皇冠赌场平台计划面临的三大挑战:

CHALLENGE 1

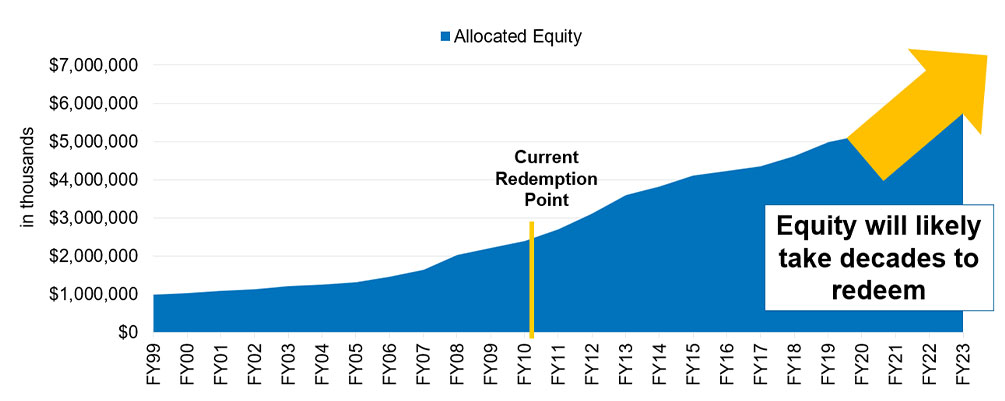

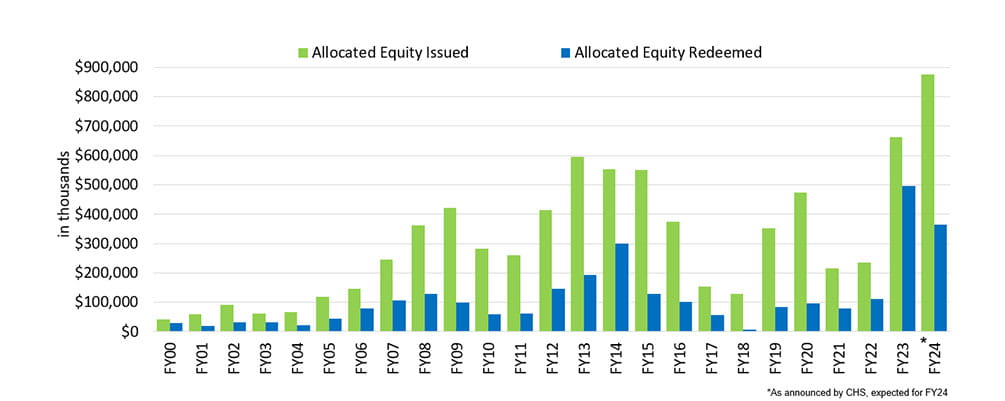

CHS发行股票的速度一直快于赎回股票的速度.

在没有变化的情况下,分配的股权量将继续增加和

could add years to redeem

不管收益如何,发行的股权已经超过赎回的股权

CHALLENGE 2

The CHS Board has had too few tools available to make effective annual equity decision; more flexibility is needed.

CHALLENGE 3

优先股股利处理导致发行的股本增加.

In the last 15 years, 已分配股本的数量增加了两倍,是1999年持有股本的五倍多. Allocated equity has grown every year, 即使在CHS盈利强劲并向CHS所有者返还大量现金的时候也是如此.

Continuing to manage equity this way would likely mean the CHS equity program has less value to owners over time, 因为赎回股权可能需要几十年的时间.

2023年CHS年会上CHS成员通过的解决方案

修改CHS章程,允许持股比例从0%提高到35%

- 给予CHS董事会根据市场情况做出股权决策的灵活性

- 这不会改变CHS产生的现金量

修订CHS章程,允许在计算赞助时通过优先股股息减少收益

- 像对待利息一样对待优先股股利

- 这不会改变CHS产生的现金量

FAQs

-

持有比例的变化会影响可用现金吗?

不,允许保留百分比的变化不会影响可用现金的数量. 每年,CHS有三个重要的领域来使用它的现金:

- 维修和保养,因为我们必须保持资产完好

- 为子孙后代再投资

- 决定通过现金赞助和股票赎回返还多少现金给国家, 带着尽可能多回来的打算.

Changing the holdback percentage will not affect the amount of money the CHS Board decides to return to owners, 因为这个数额是根据可用现金计算的, which would not change.

-

Why can't we earn our way out of this challenge?

更高的收益导致更多的股票发行,这使目前的情况更加复杂. For example, fiscal years 2022 and 2023 had record earnings and we announced record returns to owners of $1 billion and $730 million in cash, respectively, 然而,净分配所有者权益在这两年仍在增长.

CHS cannot earn its way out of this problem. We have a capital-intensive business, with ongoing significant maintenance capital expenditures needed to maintain our assets and infrastructure, 再加上必要的增长投资,以确保我们对会员保持竞争力和相关性. 因此,更高的收入并不总是转化为更多的可用现金.

-

为什么不改变优先股股息的处理方式,保留保留呢?A change only in how preferred stock dividends are treated would not make a significant impact on addressing the challenge that CHS is issuing allocated equity faster than it can redeem that equity. 同时不增加最大允许阻力, 未来赎回CHS股权的时间可能会大大延长, 随着时间的推移,股权计划对所有者的价值会降低.

-

How did you arrive at zero to 35% for holdback?

CHS咨询了税务、金融和资本结构专家来评估该计划. 税务和会计专家建议我们将最大持股比例限制在50%以下. We considered many scenarios, including a range of holdback percentages, 并研究了对分配股本量的影响, using CHS earnings history since fiscal year 1999 as examples of the range in performance possible in our market-driven business.

\We also conducted benchmarking research to understand how other cooperatives handle allocated equity and other aspects of their equity programs. From this research, it became clear that the limited flexibility in the current CHS equity program is outdated and highly unusual.

董事会最初提议的持股比例为零至45%, but believes a holdback of zero to 35% helps address the challenge while balancing the range of input received from CHS owners. 根据业主的反馈,董事会认为这种程度的灵活性将得到支持. -

What would happen if no action had been taken?

If no action had been taken by CHS members, the timeline for redeeming CHS equity in the future would likely become substantially longer than the current 15 years and could eventually grow to many decades. In addition, while the amount of equity would stay the same, 通货膨胀可能会在更长的赎回期内侵蚀其价值. 随着时间的推移,CHS对资本和流动性提供者的吸引力可能也会降低, 限制了皇冠hga010安卓二维码发展和服务业主的能力.

CHS wants to maintain a valuable and sustainable equity management program to ensure the value of current and future equity. We are working to balance current and future needs of owners and to keep the cooperative strong for future generations.

Helpful definitions

- Allocated equity通过赞助而发行并分配给特定所有者的股权.

- Equity redemption: redeeming previously issued allocated equity, 通常是现金(在CHS章程中也称为退休)

- Unallocated equity: 尚未向特定所有者发行的所有者权益. 在CHS资产负债表上作为资本公积报告的未分配权益可能包括:

- 归属于非赞助业务的年度净收入.

- An annual amount not to exceed 10% of the annual distributable net income from patronage business per current CHS Bylaws. (Please note: The bylaws amendments approved by CHS owners at the 2023 CHS Annual Meeting will adjust this figure to not exceed 35% of the annual distributable net income from patronage business. 这一变化将于2025财年开始时生效. 1, 2024.)

- 未达到最低业务量的顾客的年净收入.

Forward-looking statements: This document and other CHS Inc. publicly available documents contain, and CHS officers, 董事及代表可不时作出, “前瞻性陈述”是指美国法律规定的安全港条款.S. 1995年私人证券诉讼改革法案. 前瞻性陈述可以通过“预期”等词来识别," "intend," "plan," "goal," "seek," "believe," "project," "estimate," "expect," "strategy," "future," "likely," "may," "should,“将”和类似的对未来时期的引用. 前瞻性陈述既不是历史事实,也不是对未来业绩的保证. Instead, they are based only on CHS current beliefs, 对其业务未来的期望和假设, financial condition and results of operations, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. 因为前瞻性陈述与未来有关, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside of CHS control. CHS actual results and financial condition may differ materially from those indicated in the forward-looking statements. 因此,您不应过分依赖这些前瞻性陈述. Important factors that could cause CHS actual results and financial condition to differ materially from those indicated in the forward-looking statements are discussed or identified in CHS filings made with the U.S. Securities and Exchange Commission, including in the "Risk Factors" discussion in Item 1A of CHS Annual Report on Form 10-K for the fiscal year ended August 31, 2023. These factors may include: changes in commodity prices; the impact of government policies, mandates, regulations and trade agreements; global and regional political, economic, legal and other risks of doing business globally; the ongoing war between Russia and Ukraine; the escalation of conflict in the Middle East; the impact of inflation; the impact of epidemics, pandemics, 疾病暴发和其他不利的公共卫生发展, including COVID-19; the impact of market acceptance of alternatives to refined petroleum products; consolidation among our suppliers and customers; nonperformance by contractual counterparties; changes in federal income tax laws or our tax status; the impact of compliance or noncompliance with applicable laws and regulations; the impact of any governmental investigations; the impact of environmental liabilities and litigation; actual or perceived quality, safety or health risks associated with our products; the impact of seasonality; the effectiveness of our risk management strategies; business interruptions, casualty losses and supply chain issues; the impact of workforce factors; our funding needs and financing sources; financial institutions’ and other capital sources’ policies concerning energy-related businesses; technological improvements that decrease the demand for our agronomy and energy products; our ability to complete, integrate and benefit from acquisitions, strategic alliances, joint ventures, divestitures and other nonordinary course-of-business events; security breaches or other disruptions to our information technology systems or assets; the impact of our environmental, social and governance practices, including failures or delays in achieving our strategies or expectations related to climate change or other environmental matters; the impairment of long-lived assets; the impact of bank failures; and other factors affecting our businesses generally. Any forward-looking statements made by CHS in this document are based only on information currently available to CHS and speak only as of the date on which the statement is made. CHS没有义务更新任何前瞻性声明, whether written or oral, that may be made from time to time, whether as a result of new information, 未来发展或其他情况,除非适用法律要求.